1. ORDERS 2. CHANNELS 3. PRODUCTS 4. CATEGORIES 5. COMBINATIONS 6. INVOICES 7. TAXES 8. PAYMENTS 9. SHIFTS 10. IN/OUT 11. GIFT CARDS

This section provides detailed information about sales made on the platform. From the quantity of products sold to customer details, these reports offer a comprehensive view of business activity. Broken down by categories such as orders, products, invoicing, and more, these reports are essential tools for analysing and tracking business profitability.

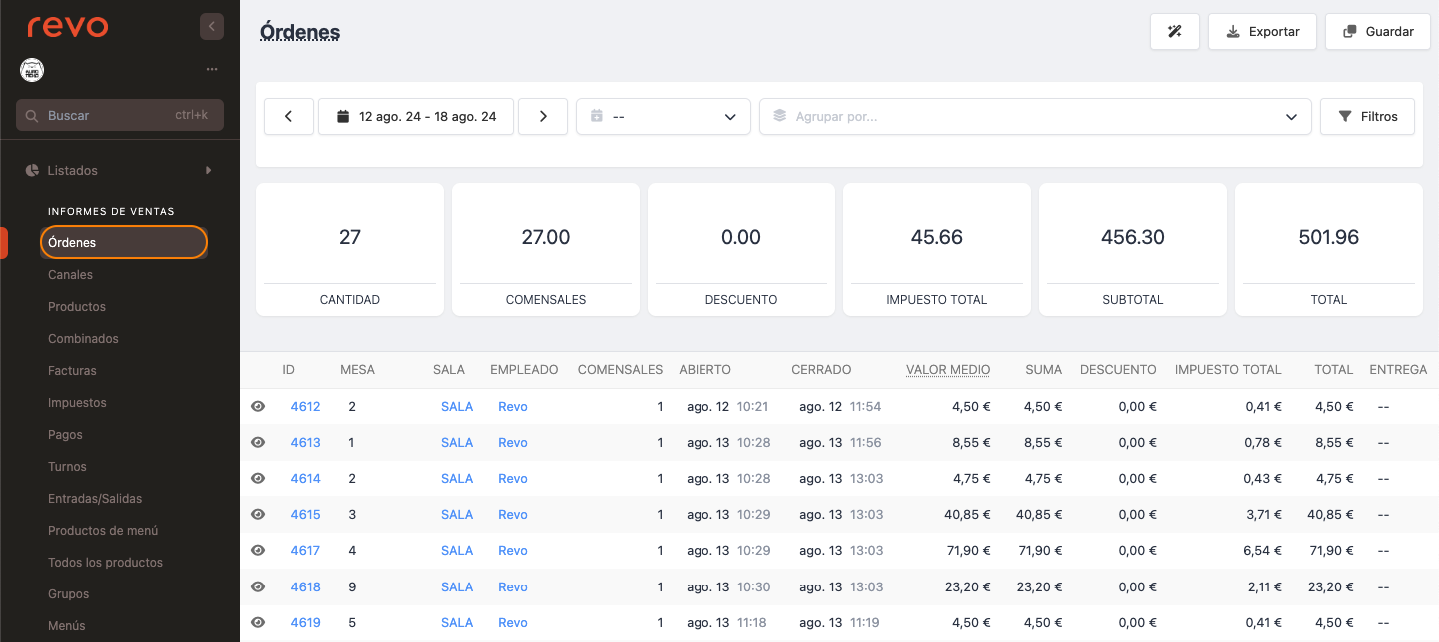

1. ORDERS

This report provides a detailed view of the orders placed on your platform, allowing easy access to see everything that has happened from the beginning to the end of each order. It includes information such as invoices, products, customers, opening and closing dates, number of guests, etc. Additionally, you have the ability to review the activity of each order in detail for 15 days, leading directly to the activity log filter for the specific order.

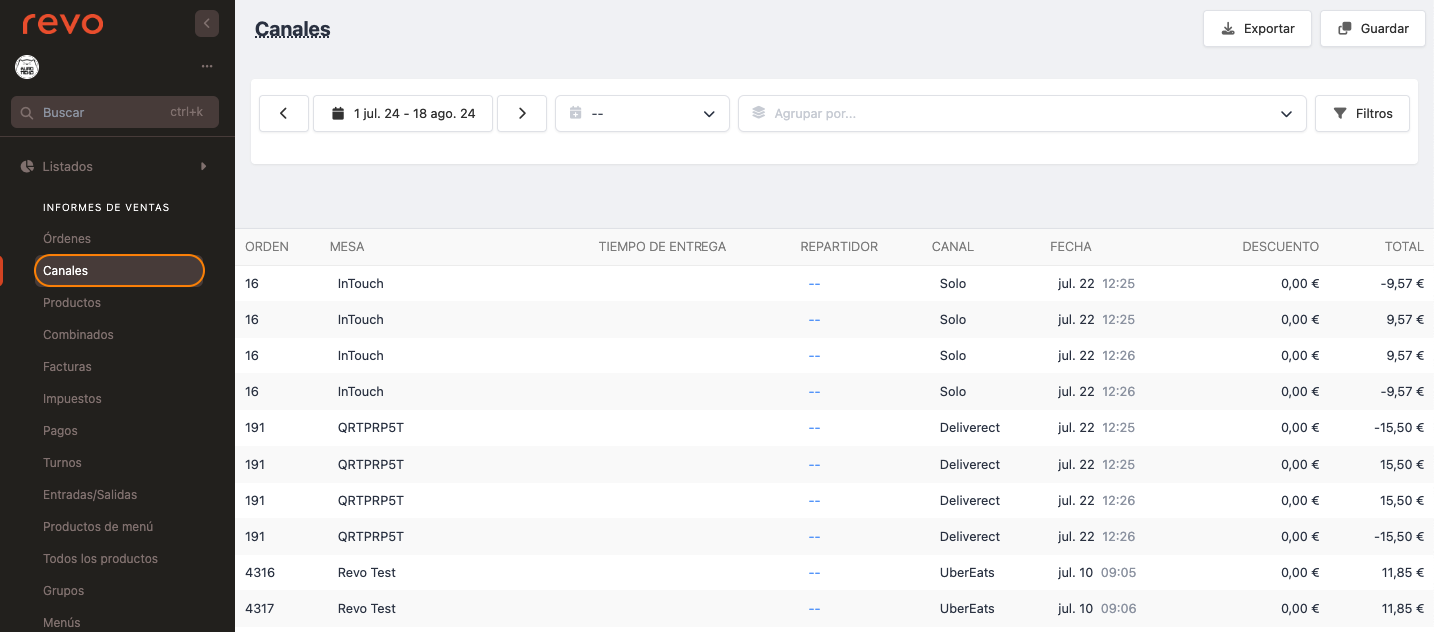

2. CHANNELS

This section allows you to easily and comprehensively view orders created through integrated channels.

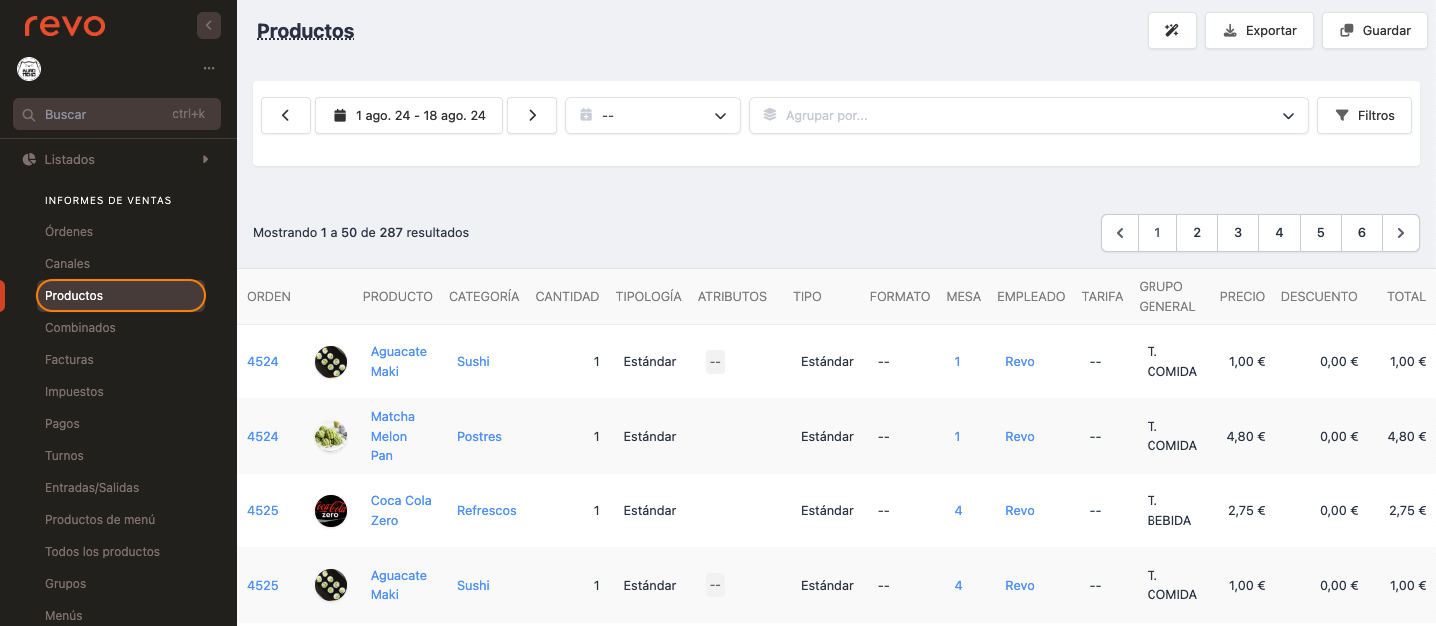

3. PRODUCTS

The report displays a detailed list of products sold at an establishment, categorized by type, with specific information on quantity, margin, type, price, discount, tax, total, as well as the sales date. Other relevant details include the location of the sale (table) and the responsible employee. It serves as a useful tool for tracking sales and analysing product profitability.

These data is based on orders placed and in progress, not on billing.

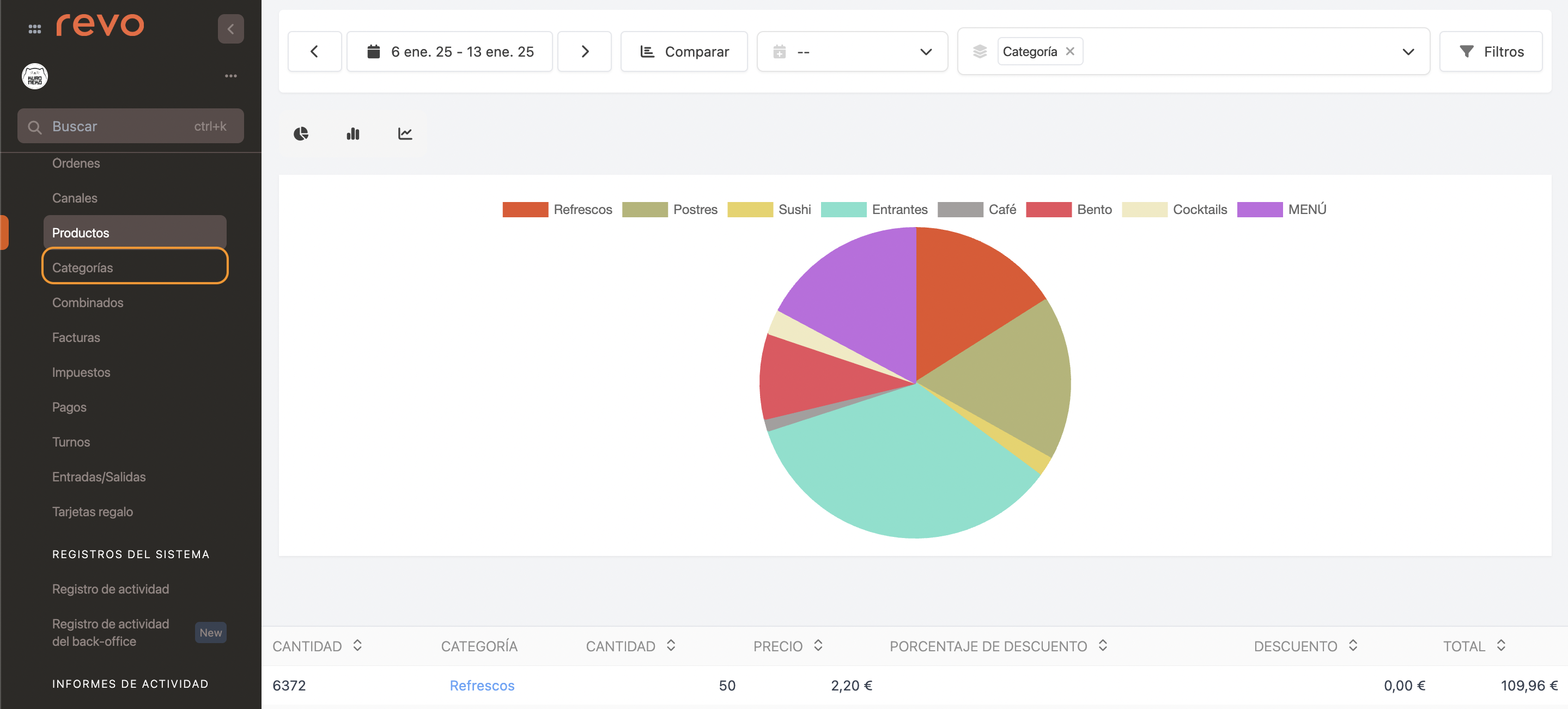

4. CATEGORIES

The report displays a list of the categories of products sold in an establishment. It is a useful tool for tracking sales and analysing the profitability of products.

This data is based on orders placed and in progress, not on invoicing.

5. COMBINATIONS

This report shows combinations of items sold, the employee who made the sale, order number, price, and transaction date. It is useful for tracking customer preferences and the sales performance of combinations.

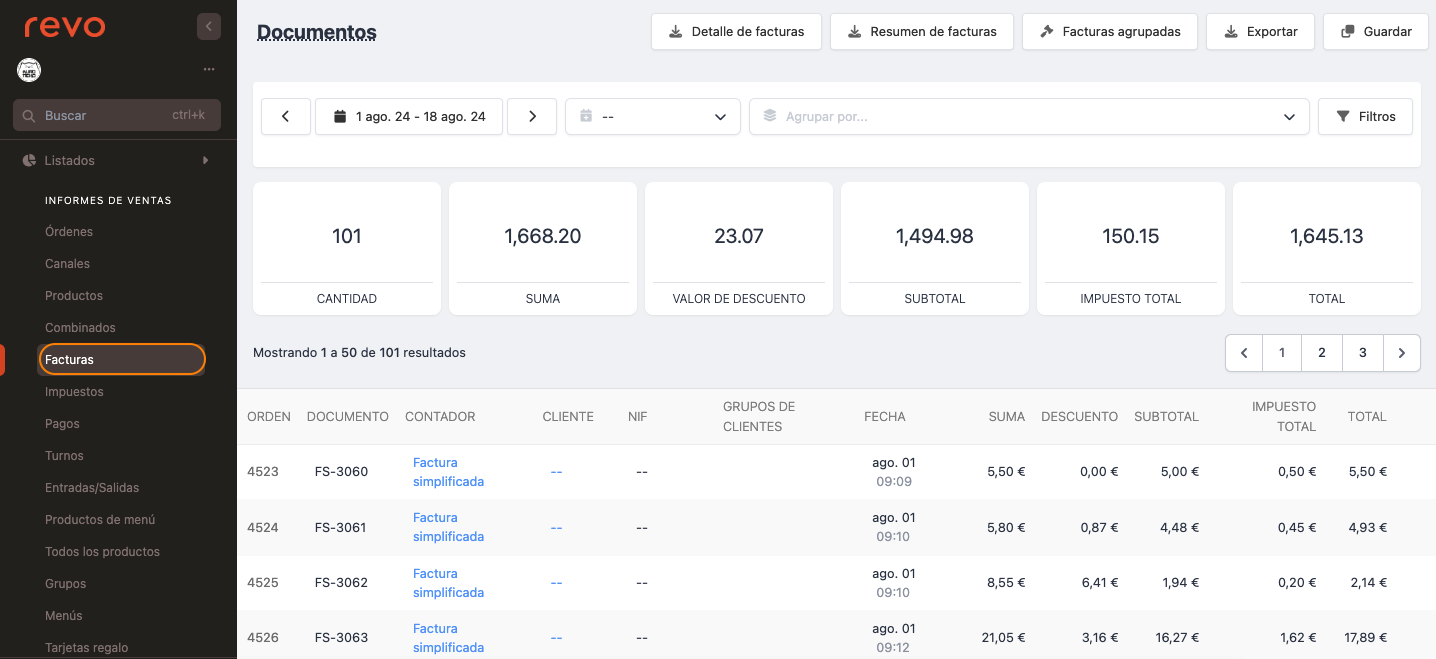

6. INVOICES

This report provides details of each generated document and the order in which it was made. From here, you can view simplified invoices, named invoices, returns, delivery notes, and invoices generated offline to differentiate them.

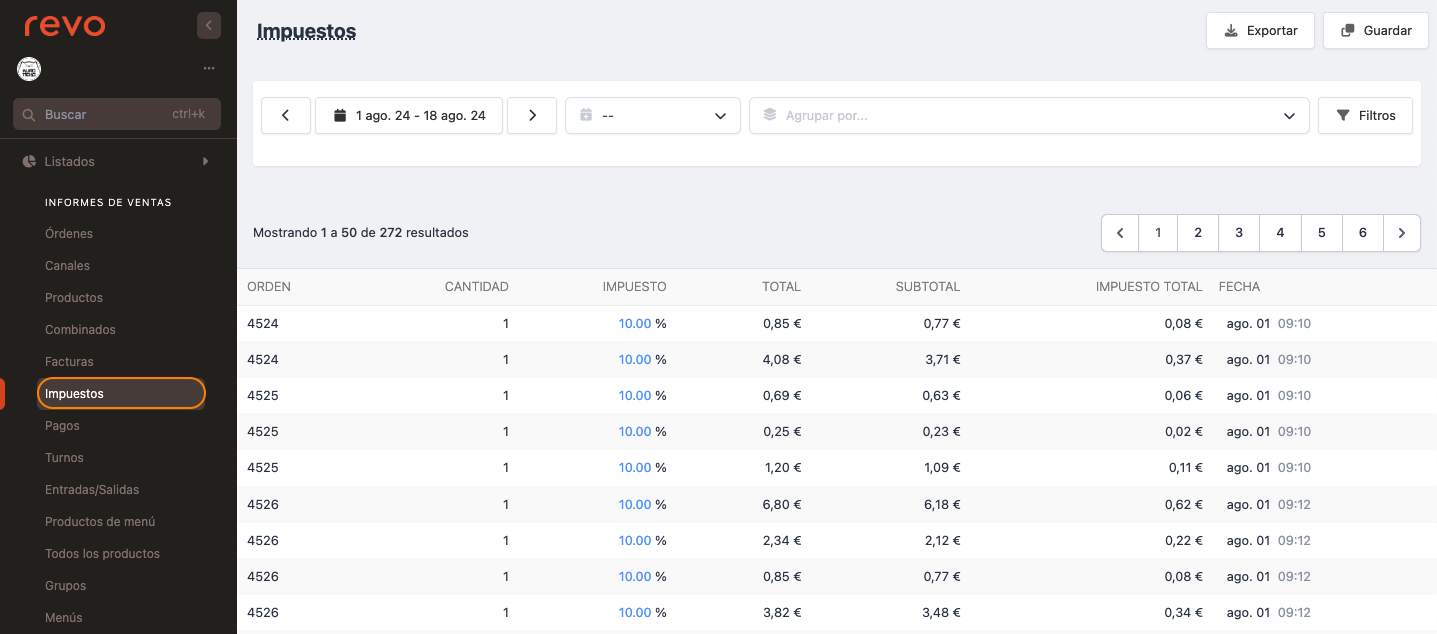

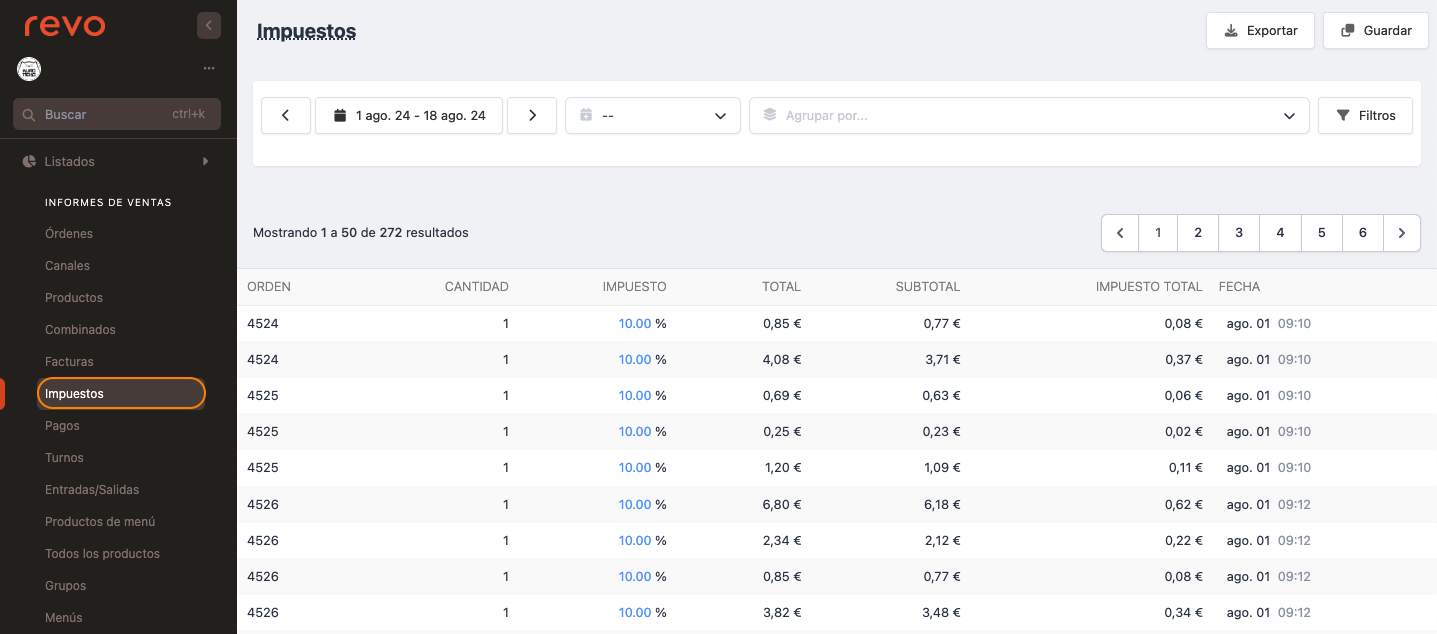

7. TAXES

Details the processed transactions, identifying the tax, the total, and the date.

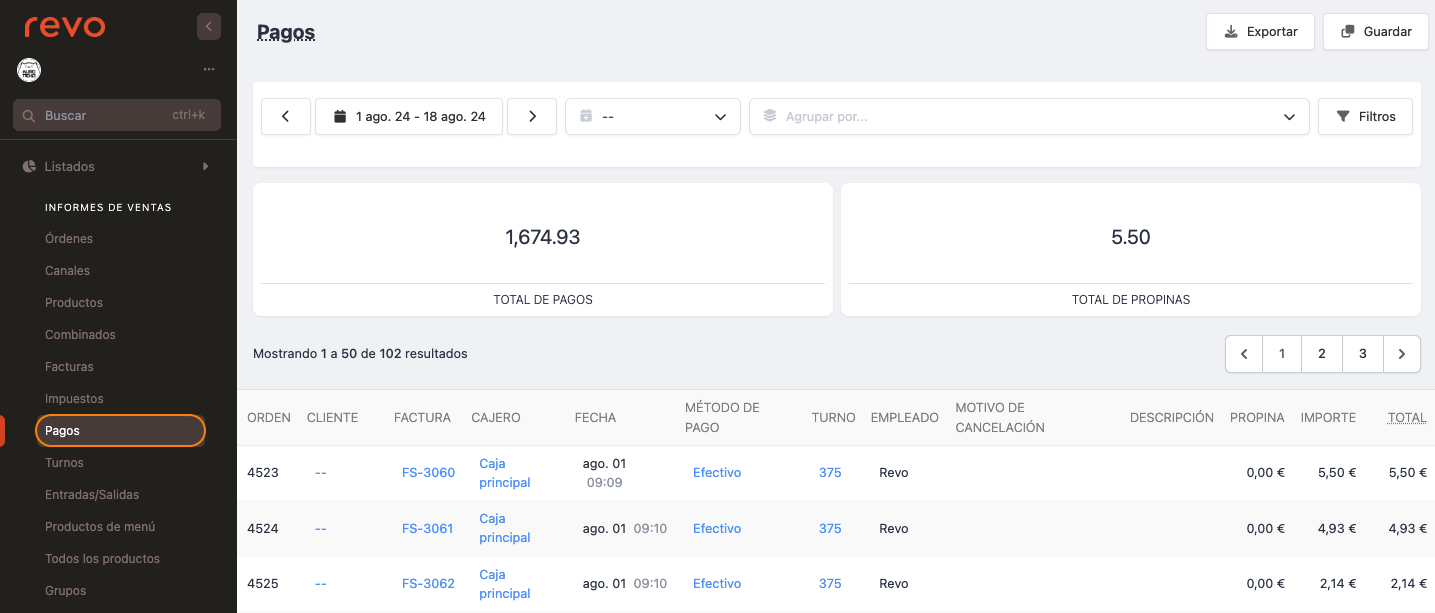

8. PAYMENTS

It details processed transactions, identifying the payment method, the employee who conducted the transaction, and associated tips, crucial for income tracking.

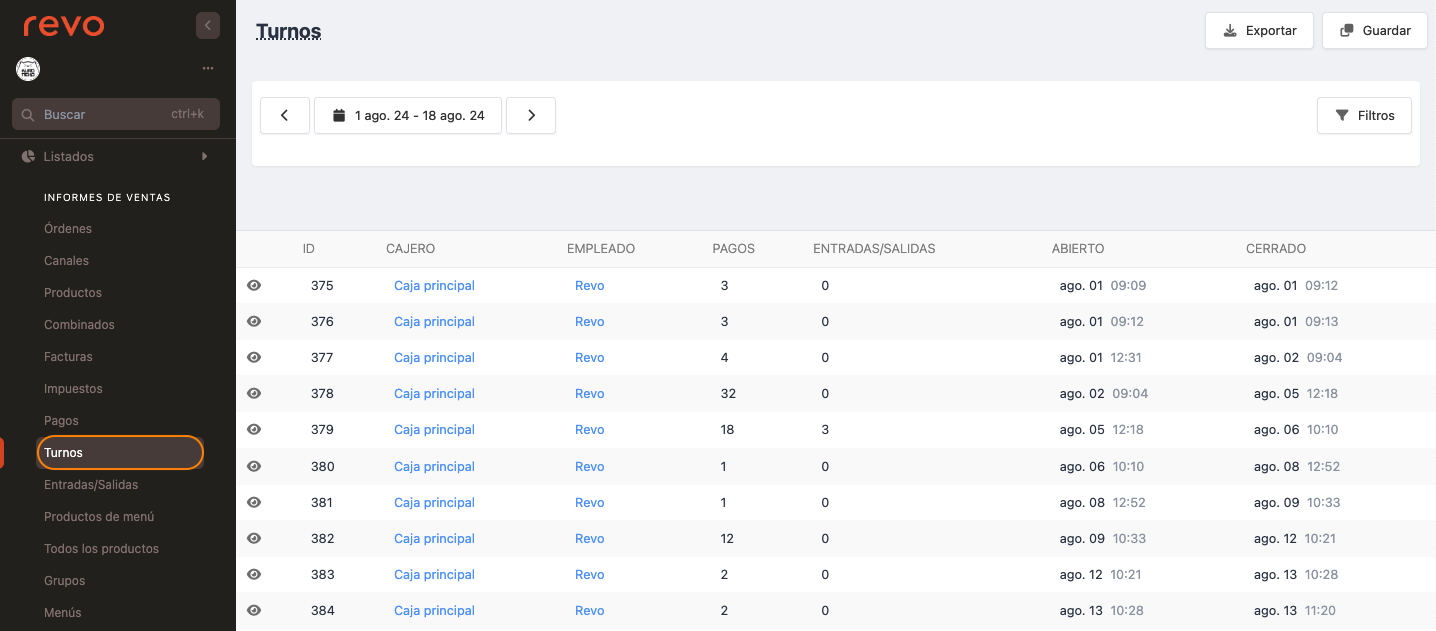

9. SHIFTS

Registers the cycles of each cash register, showing the start and end times of each shift and the responsible cashier.

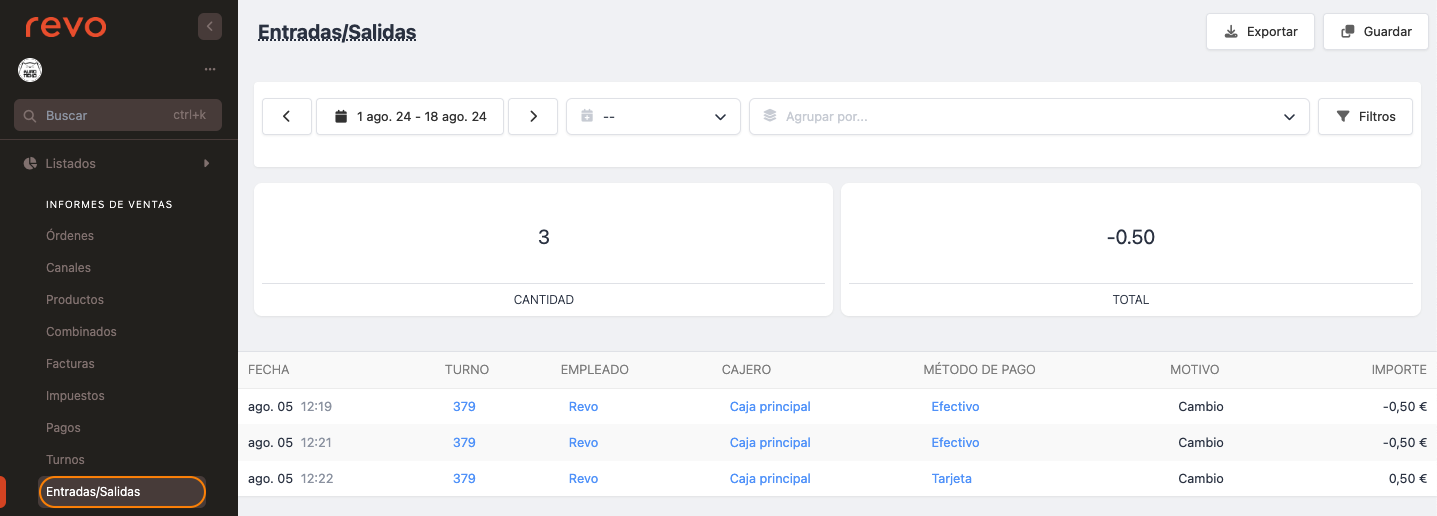

10. IN/OUT

Controls cash flow, documenting cash input and output operations, essential for cash auditing.

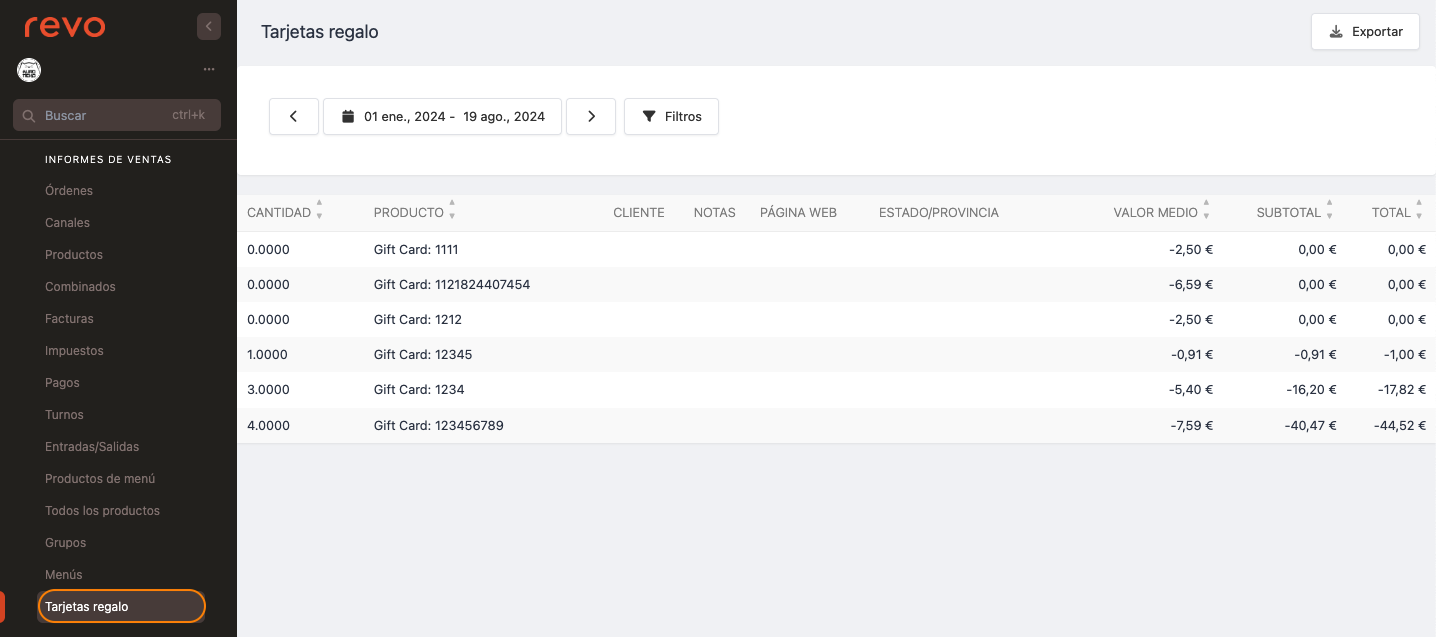

11. GIFT CARDS

Gift cards are an excellent means to increase sales and customer loyalty. The "Gift Cards" report from Revo XEF allows businesses to track and analyse the usage of these cards.

The report shows detailed data such as the number of cards sold, the products associated with each card, the customer acquiring them, and the average, subtotal, and total value of each transaction. This information is essential for evaluating the effectiveness of gift card campaigns and understanding consumer behaviour.