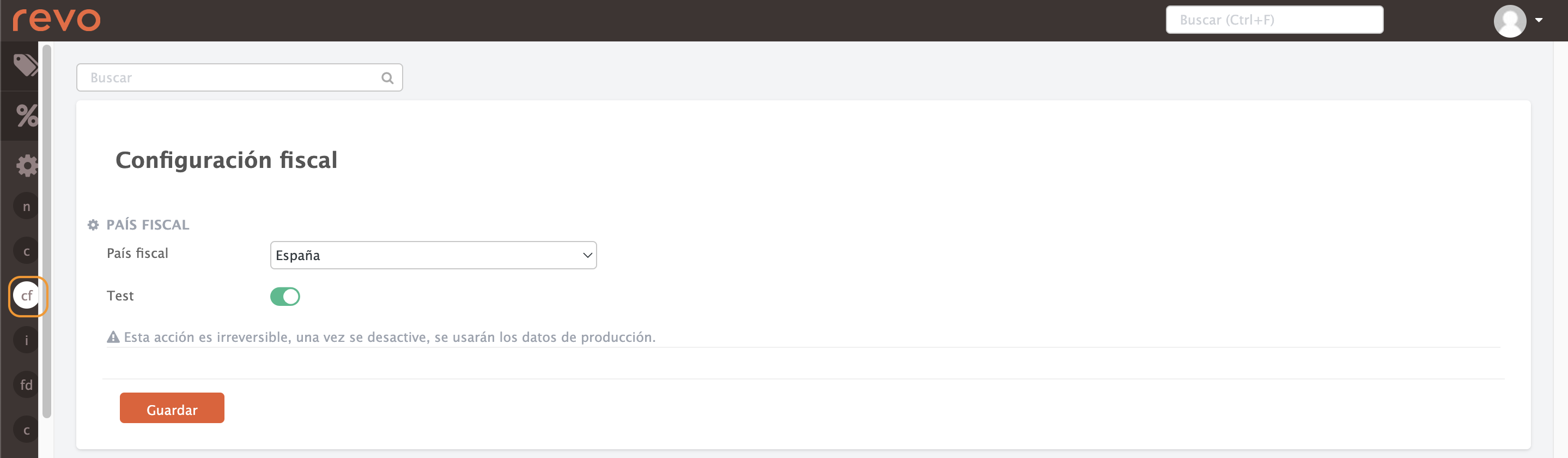

Once the customer account has been created, make sure that the tax configuration is correctly set up. Follow these steps:

1. Log in to the back office of Revo RETAIL.

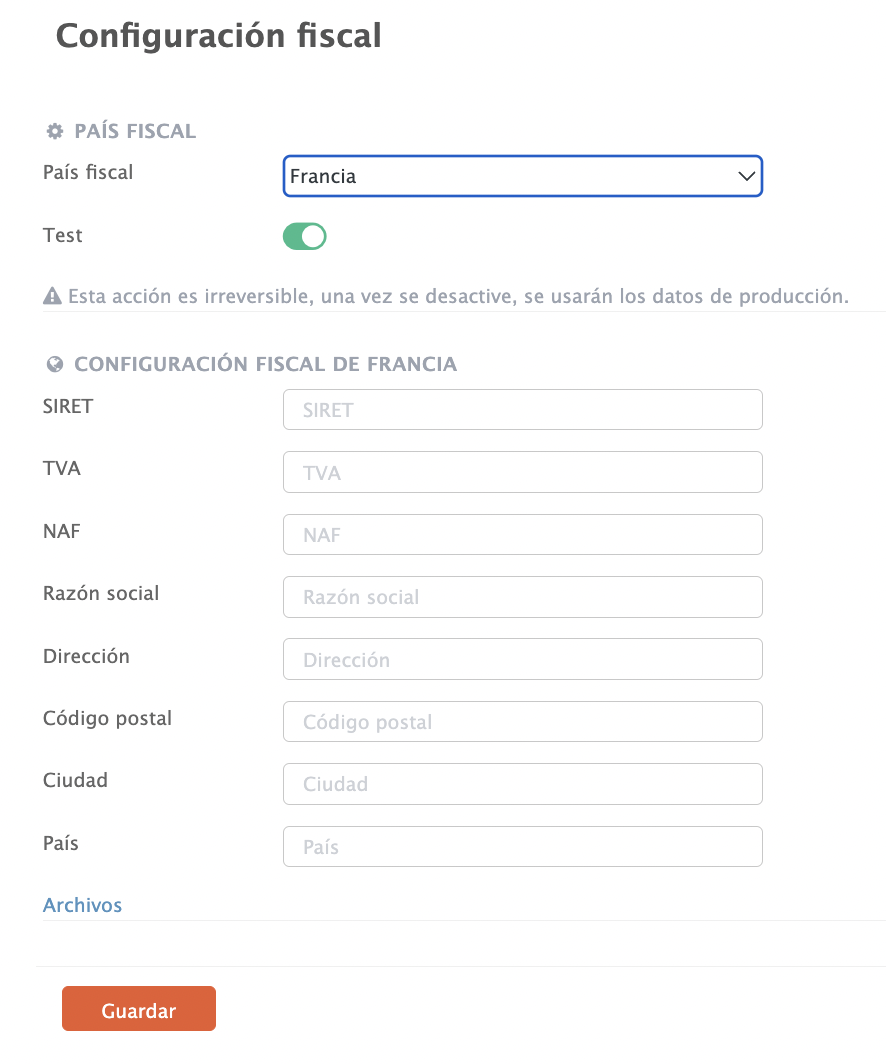

2. Go to Settings / TAX CONFIGURATION.

-

Tax country: Select your country from the dropdown menu.

-

Test mode: Disable it when you are ready to send data to production.

IMPORTANT: This action is irreversible.

3. Click Save.

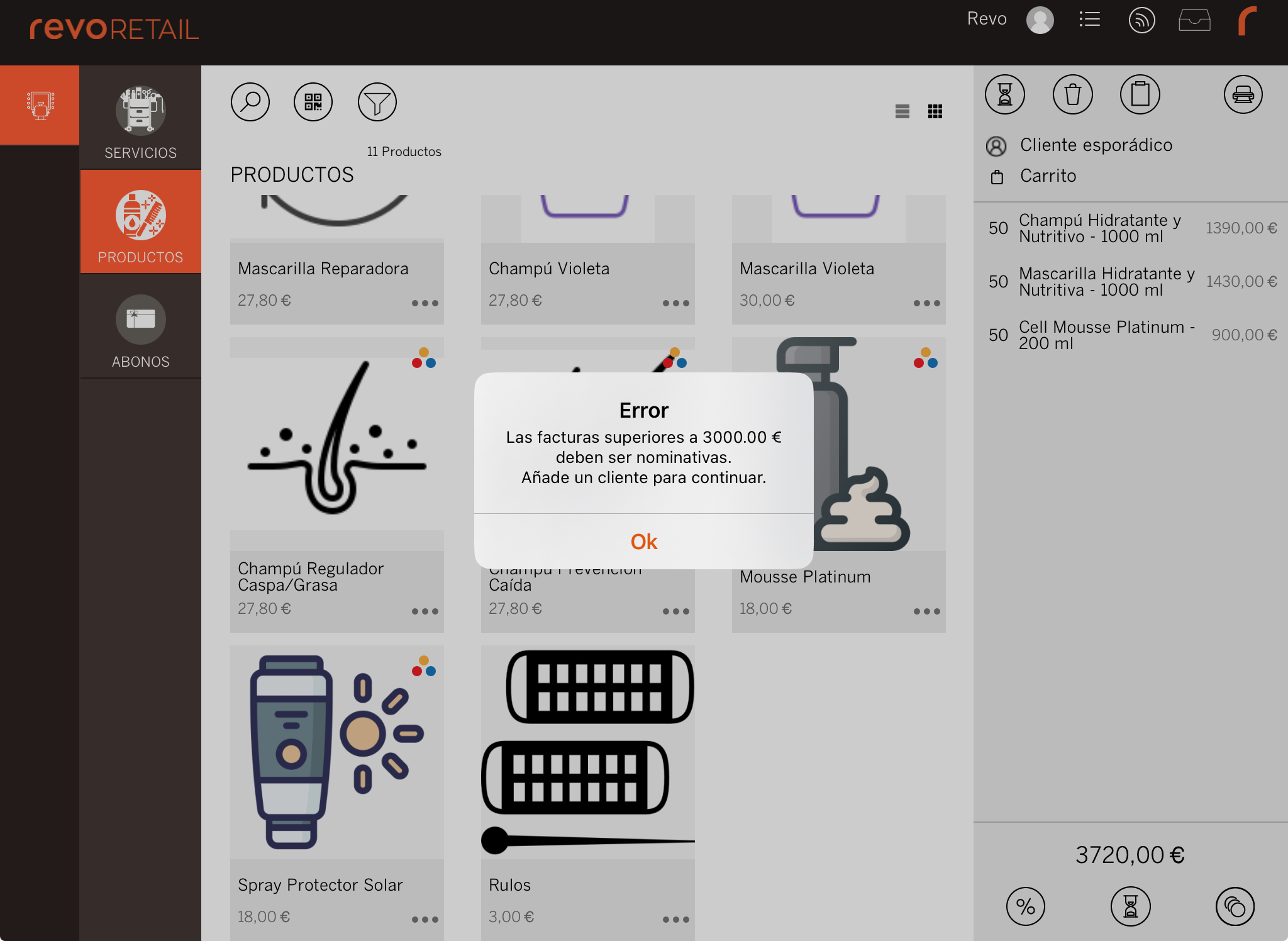

In Spain, simplified invoices cannot exceed €3,000. If this happens, you must issue a nominative invoice. Don’t forget to create the necessary counters, learn how here.

TAX COUNTRIES WITH EXTRA CONFIGURATION

If you operate in the Basque Country (Spain) or France, additional information is required.

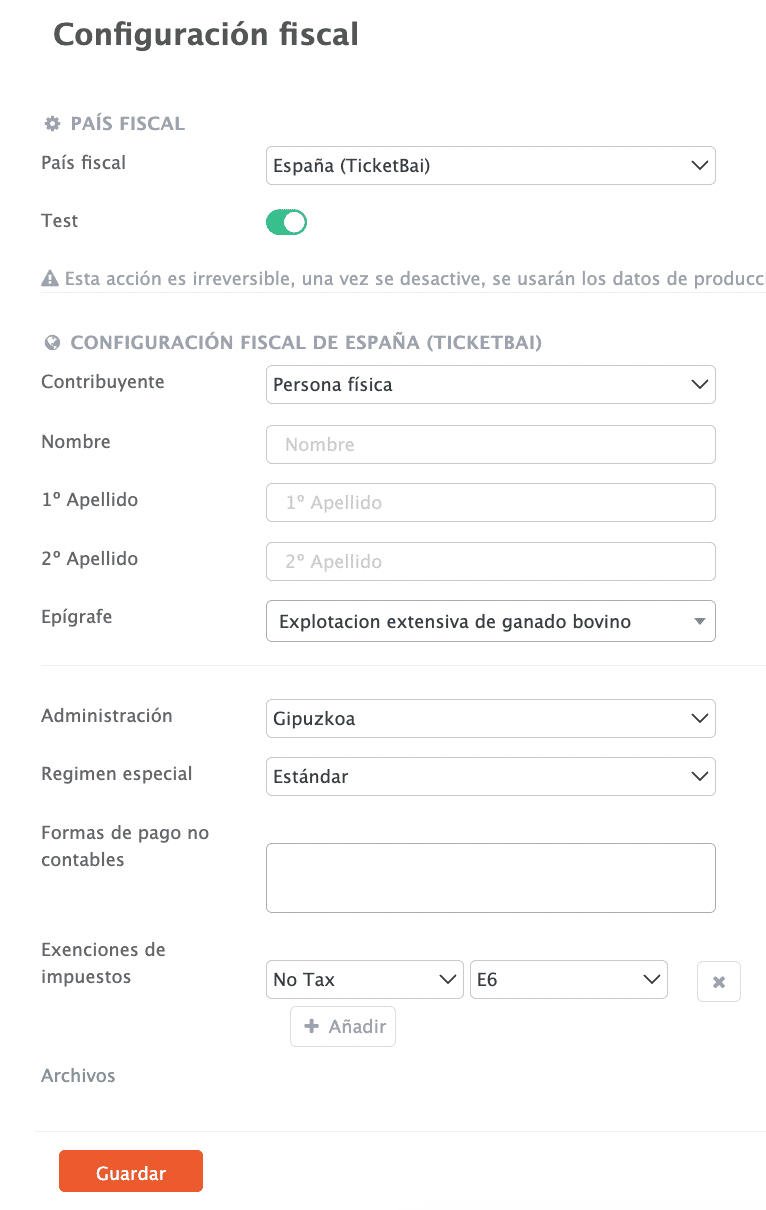

SPAIN (TicketBAI)

-

Tax Country: Spain (TicketBAI).

-

Taxpayer Type: Individual or Legal Entity.

If you choose Legal Entity, not all options will be available.

-

Full Name: Business owner's details.

-

Activity Code: Select the one that matches your business.

-

Tax Authority: Gipuzkoa, Biscay, or Álava.

-

Special Scheme: Choose the applicable one: Standard, Special Equivalence Surcharge Scheme, or Simplified VAT Scheme.

-

Non-accounting payment methods: Select the applicable ones.

-

Tax Exemptions: Indicate the tax and the type of exemption.

-

Files: Check the XML files sent to TicketBAI.

More information here.

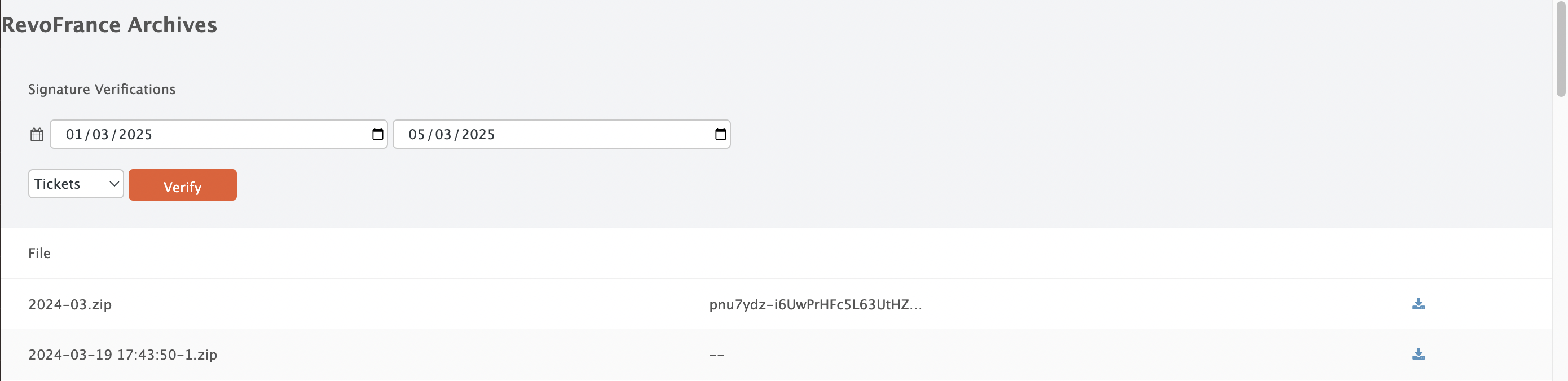

FRANCE

-

Alcohol menu pricing: Create and select an alcohol price rate. More details on pricing here.

-

SIRET, TVA, and NAF: Enter the corresponding codes.

-

Company name, address, postcode, city, and country: Fill in these details.

-

Files: View and verify the generated files.