1. WHAT IS VERIFACTU? 2. CONFIGURING VERIFACTU IN REVO 3. TAX STATUS IN INVOICES 4. CONFIGURING NO VERIFACTU IN REVO

1. WHAT IS VERIFACTU?

VERIFACTU is a system driven by the Spanish Tax Agency to combat tax fraud and promote the digitization of invoicing. It works by verifying electronic invoices, ensuring their authenticity, integrity, and traceability, and automatically sending the information to the CEGID.

To comply with VeriFactu requirements, you must choose between two options:

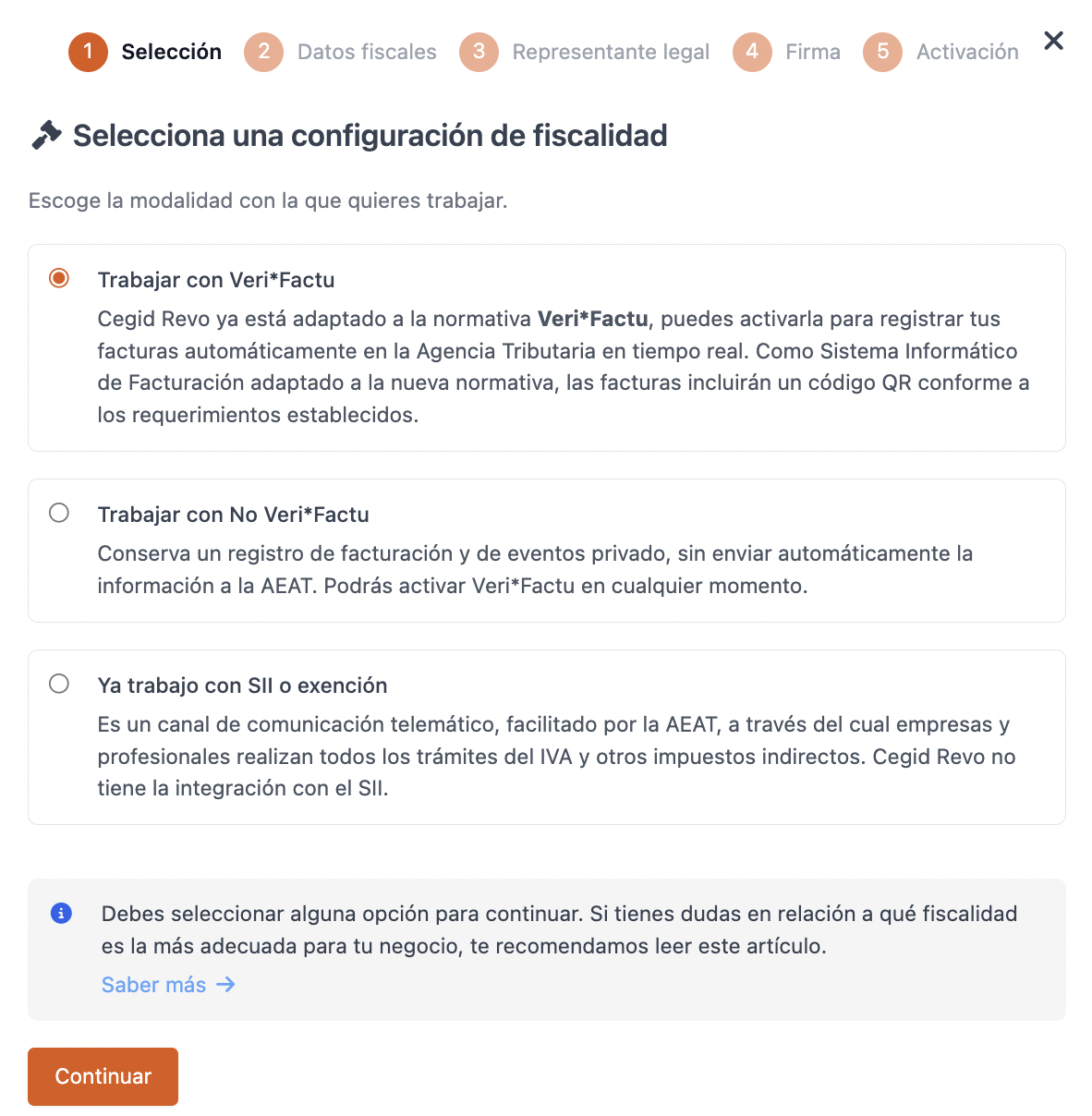

- Option 1: "Work with VERIFACTU": Direct and automatic submission to the Tax Agency upon invoice creation.

- Option 2 "Work with No VERIFACTU": No direct submission upon invoice creation, but a billing record is maintained that meets the set of requirements established by the Tax Agency.

IMPLEMENTATION OF THE NEW REGULATION

You must use software adapted to VeriFactu and have the tax settings configured by the following dates:

Companies: January 1, 2026.

Self-employed: July 1, 2026.

If your company uses the SII system or exemption, you must select the option "I already work with SII or exemption" in the Tax Settings.

We recommend that, starting July 29, you take advantage of the transitional period to activate VeriFactu and prevent last-minute issues.

Recommendation: Activate it starting July 29 to take advantage of the transition period and avoid last-minute issues.

2. CONFIGURING VERIFACTU IN REVO

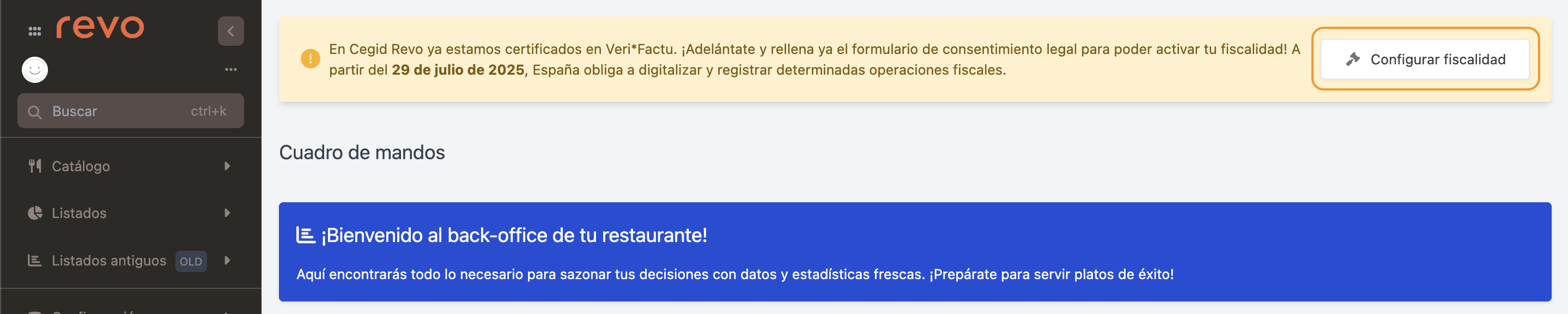

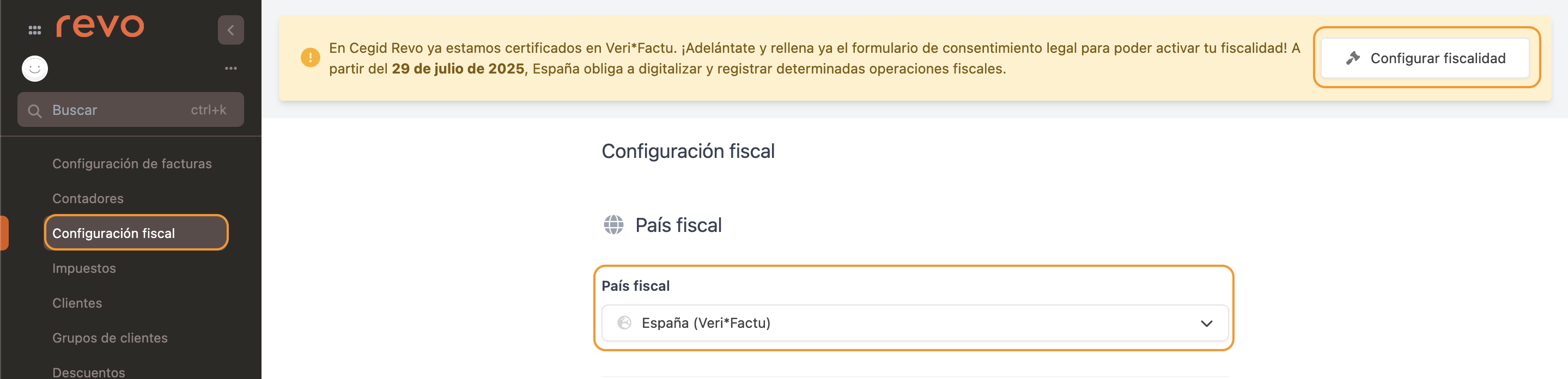

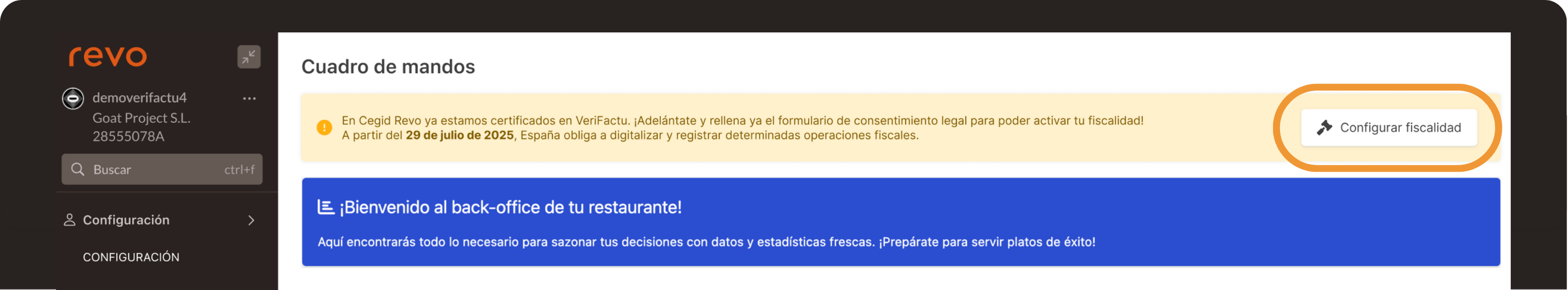

Upon accessing the back-office, a message will appear indicating that tax settings need to be configured. Click on Configure Tax Settings.

Note: For existing customers, the Configure Tax Settings button will appear. It will only allow activation if the iPads have version 4.8.6 or higher.

You can also:

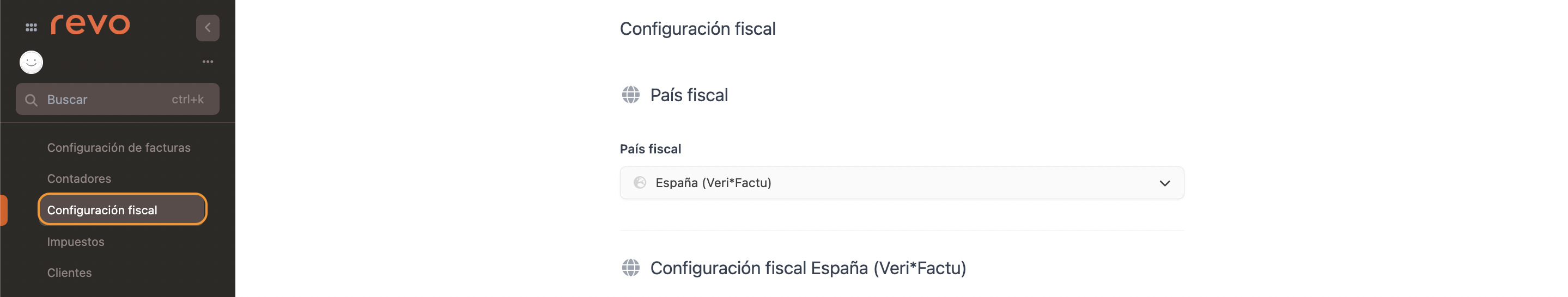

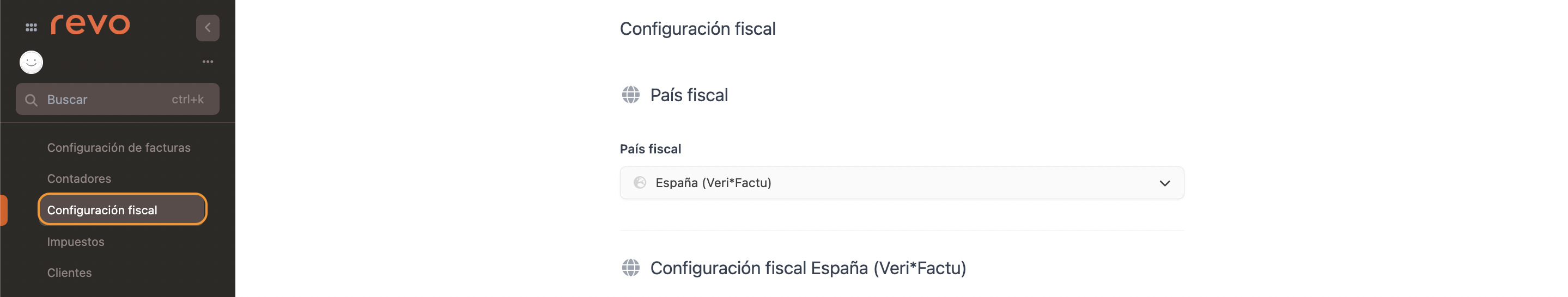

1. Access the back-office of Revo XEF.

2. Go to Settings / TAX SETTINGS.

3. Click on Configure Tax Settings.

Make sure to select Tax Country: Spain (Veri*Factu)

4. Fill in the data.

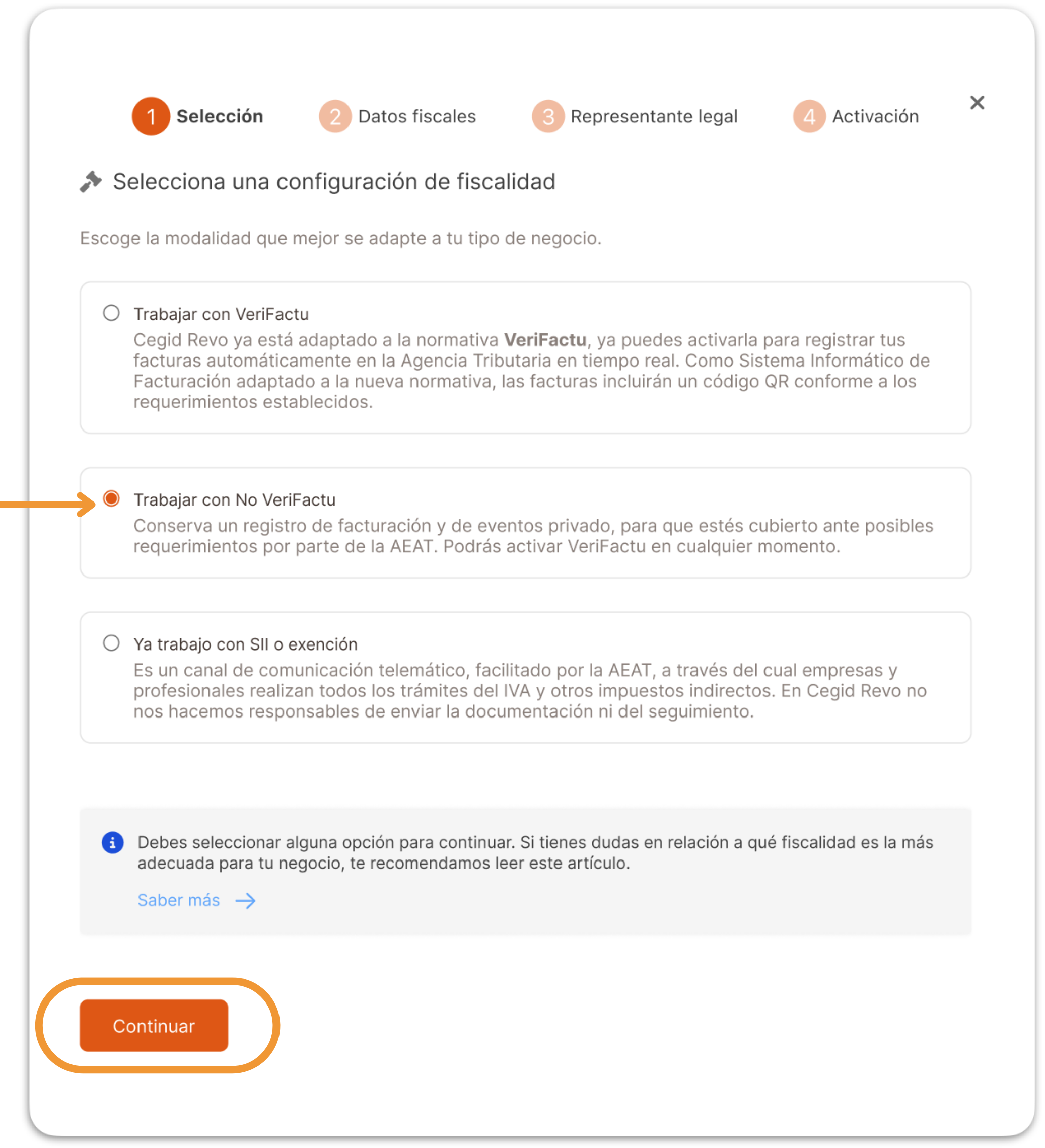

SELECTION

Select whether to work with Veri*Factu, not use it, or if you already use SSI.

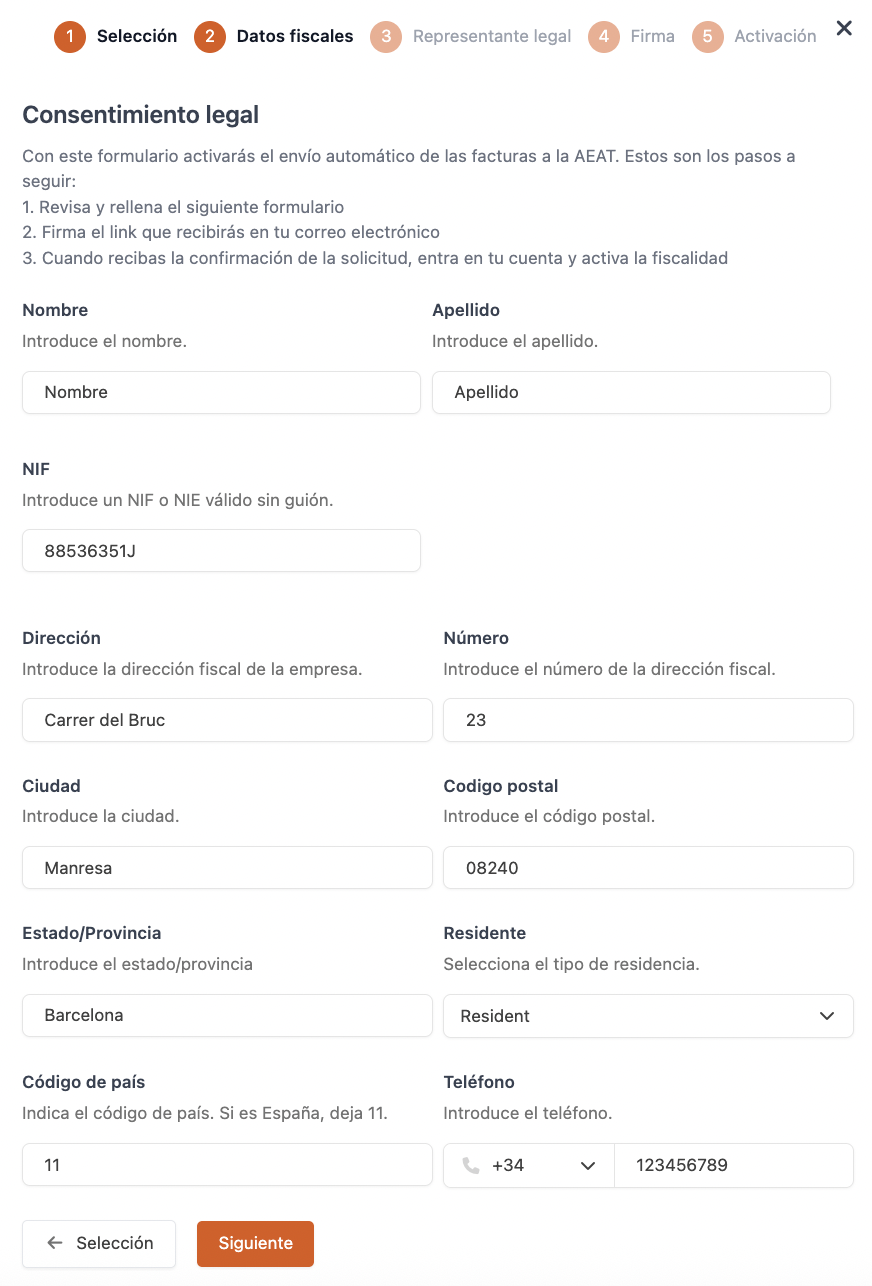

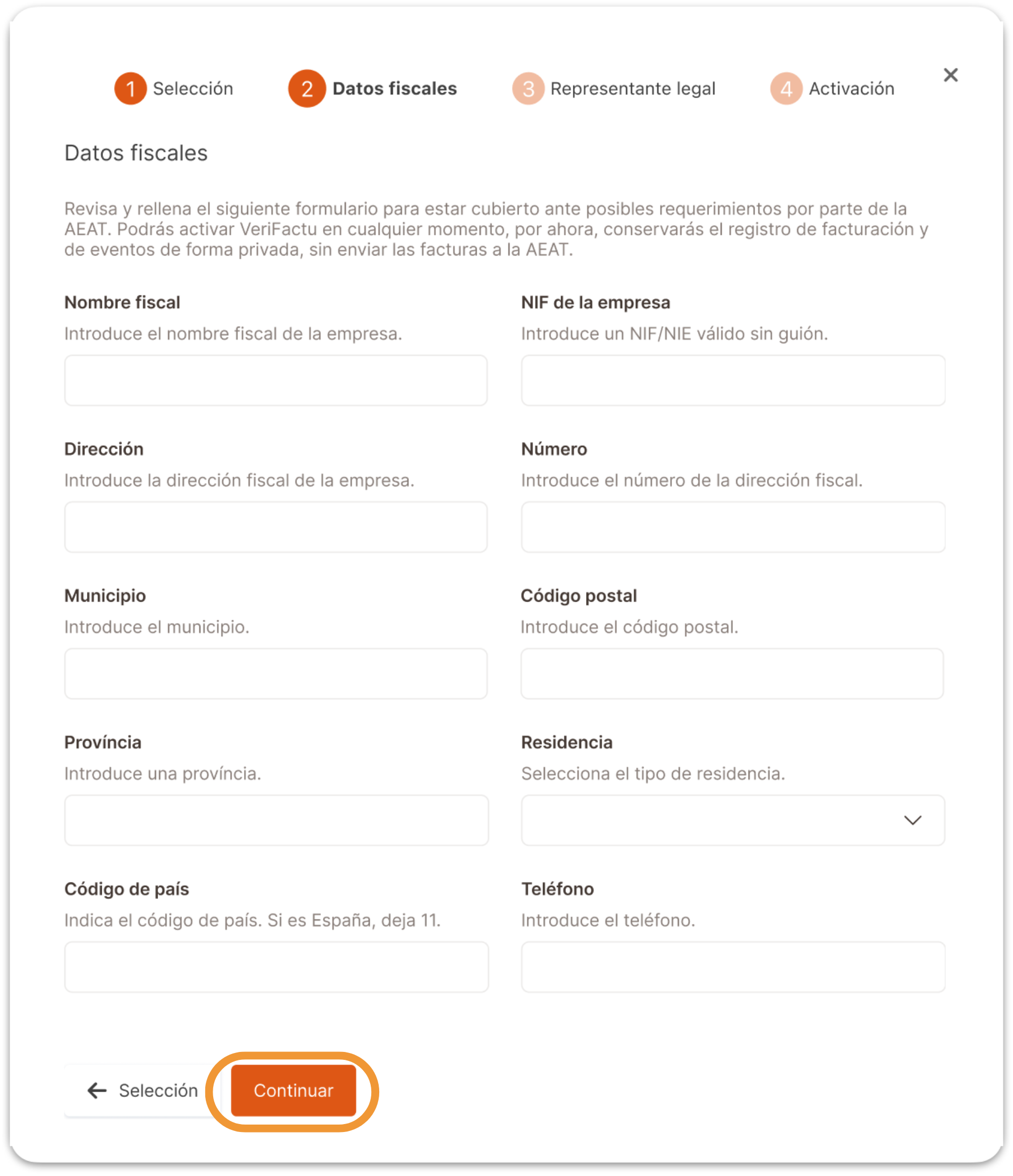

TAX DATA

This information is directly extracted from the Company section of the back-office. Ensure all is correct.

- Country Code: 11 for Spain.

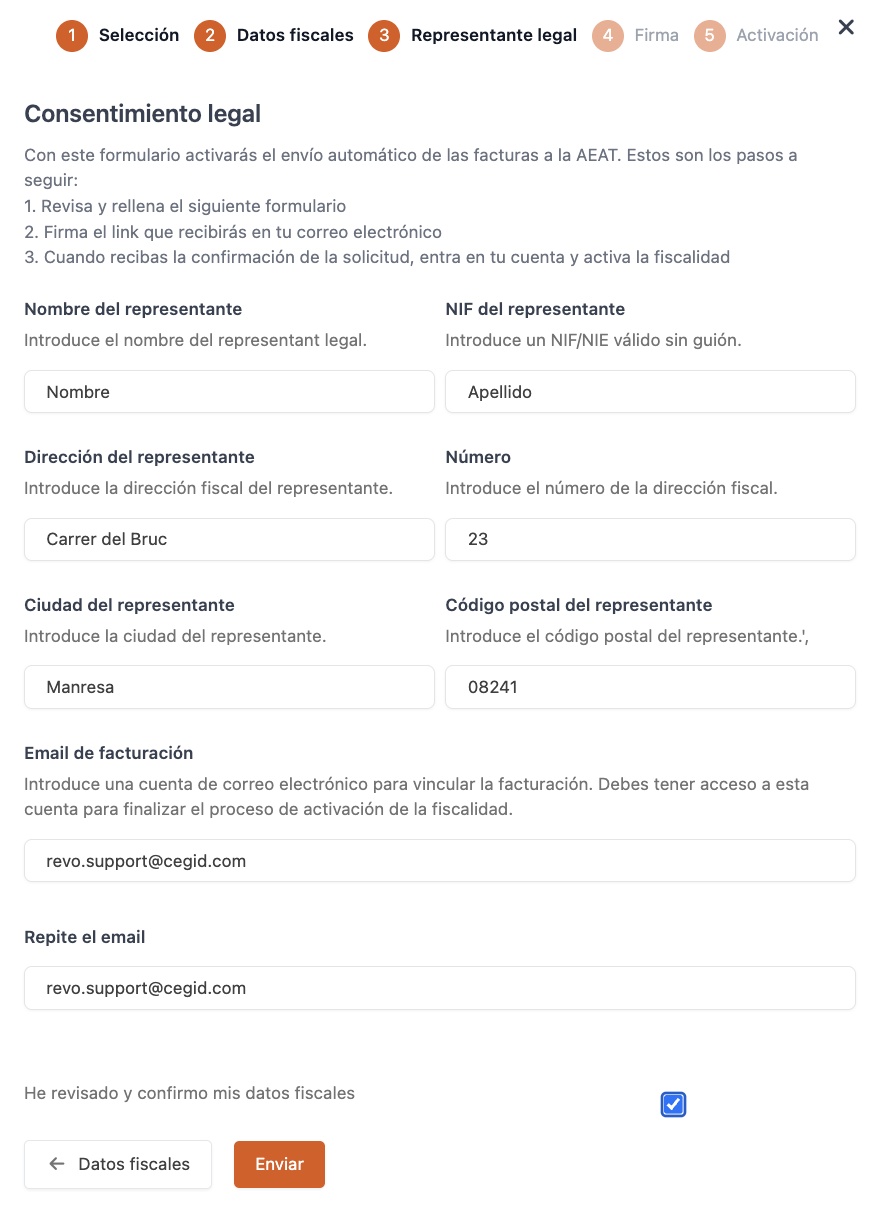

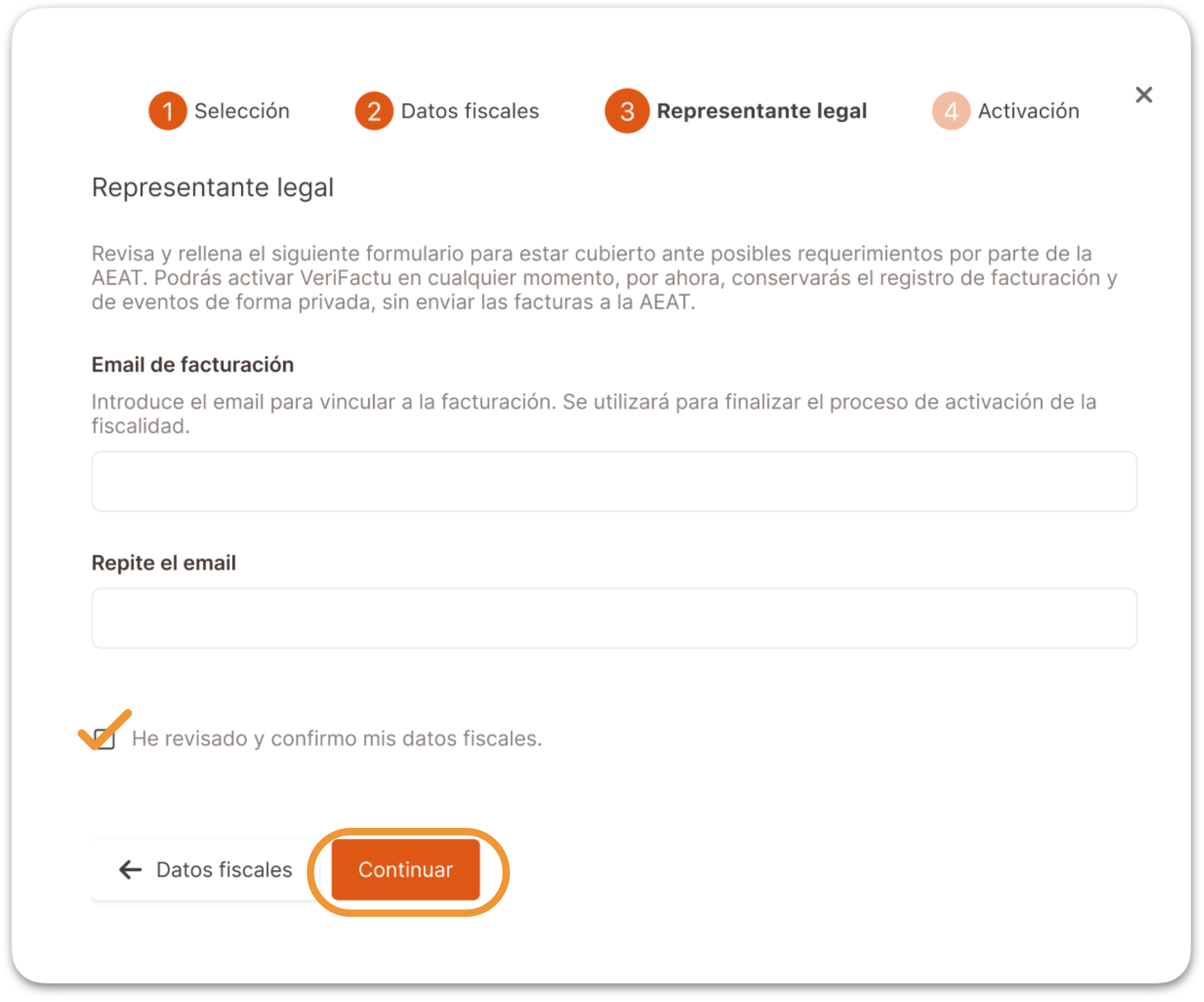

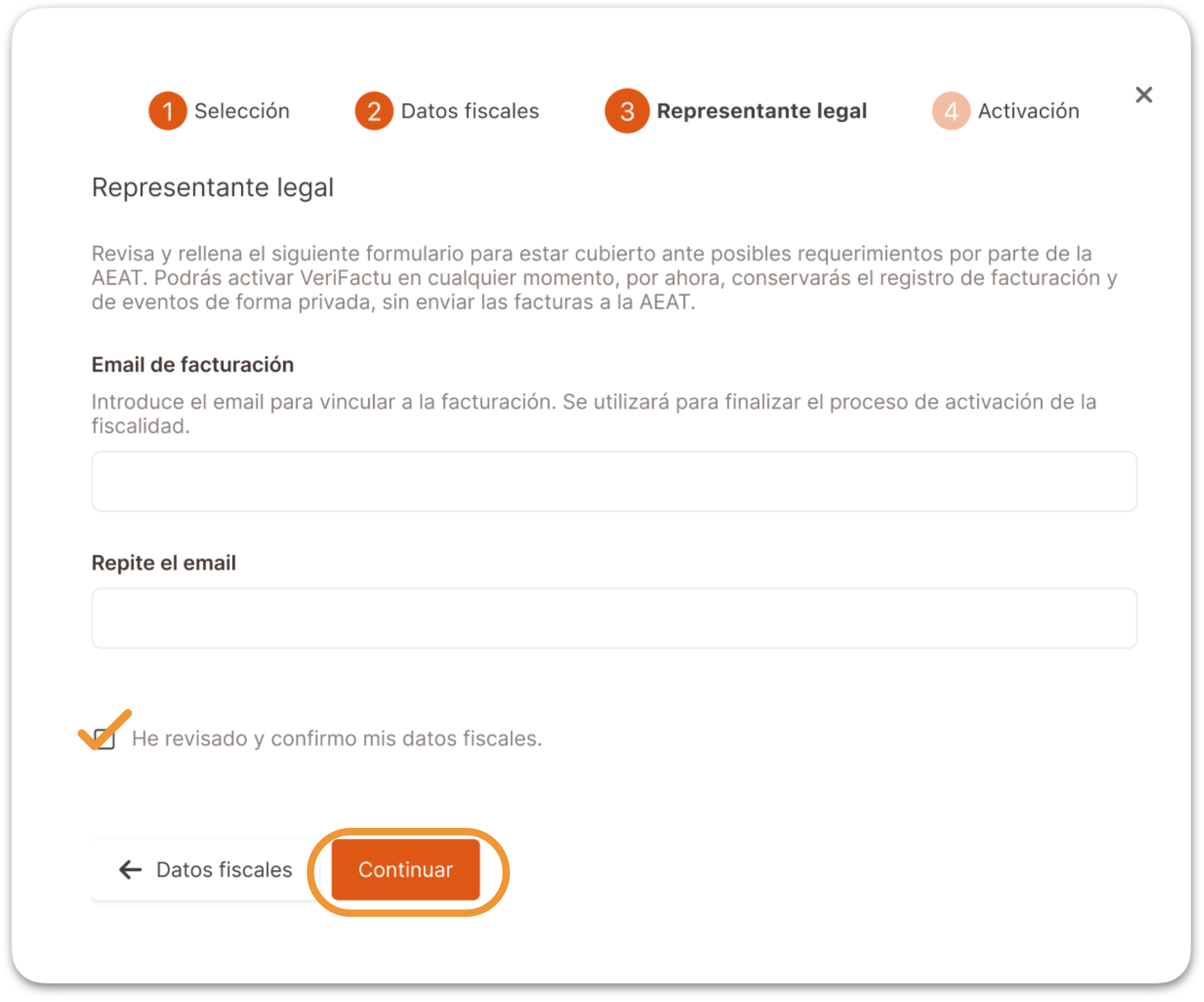

LEGAL REPRESENTATIVE

Fill in the legal representative's data.

It is important that the email you add is accessible as you will need to respond to the email sent from AEAT.

Remember to check I have reviewed and confirm my tax data.

Click Send.

SIGNATURE

You will receive an email where you will need to sign the legal consent for Cegid Revo to manage the data.

Once signed, you will receive an email with the signed copies and can continue the process by clicking I have signed.

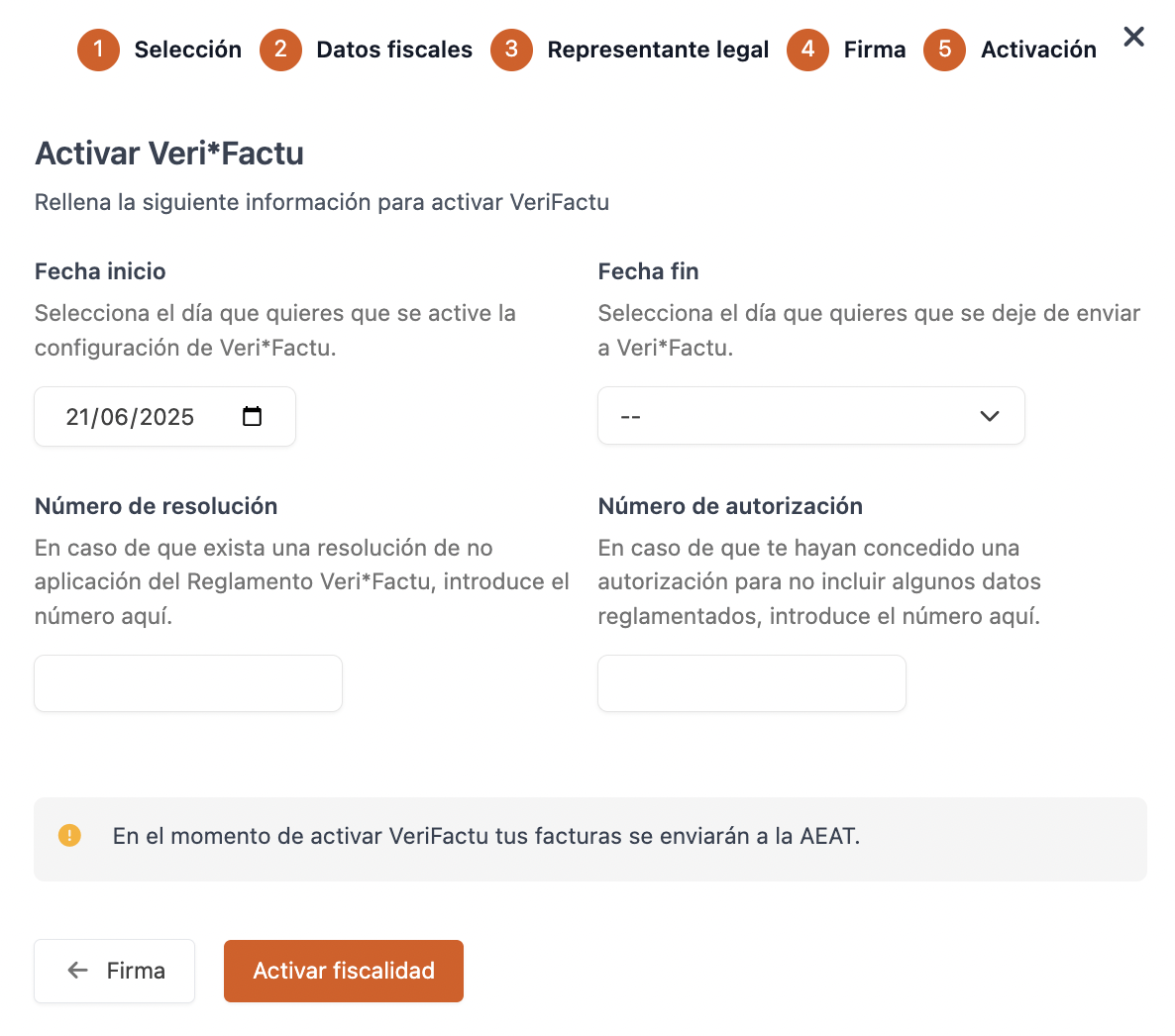

ACTIVATION

5. Complete the required information.

- Start Date: Must be the current date or a previous date (anyway, after April 23, 2025).

-

End Date (optional) OPTION NOT YET AVAILABLE: If you want to work in "VeriFactu" mode without a deadline, leave this field empty. If you plan to change modes, select the date 12/31 of the end of the year when you will stop working in "VeriFactu" mode to switch to "No VeriFactu".

Resolution number and authorization number (if applicable).

6. Once done, click on Activate Tax Settings.

7. You can review your tax settings at any time in the back-office of Revo XEF, in the Settings / Company / TAX SETTINGS section.

Done! Your tax settings are activated!

Once activated, you will no longer be able to modify the tax country, and the message indicating activation will disappear.

3. TAX STATUS IN INVOICES

Once sales are generated in Revo XEF, tickets will be printed with the tax QR code. If scanned, it will lead to the tax agency for invoice tracking.

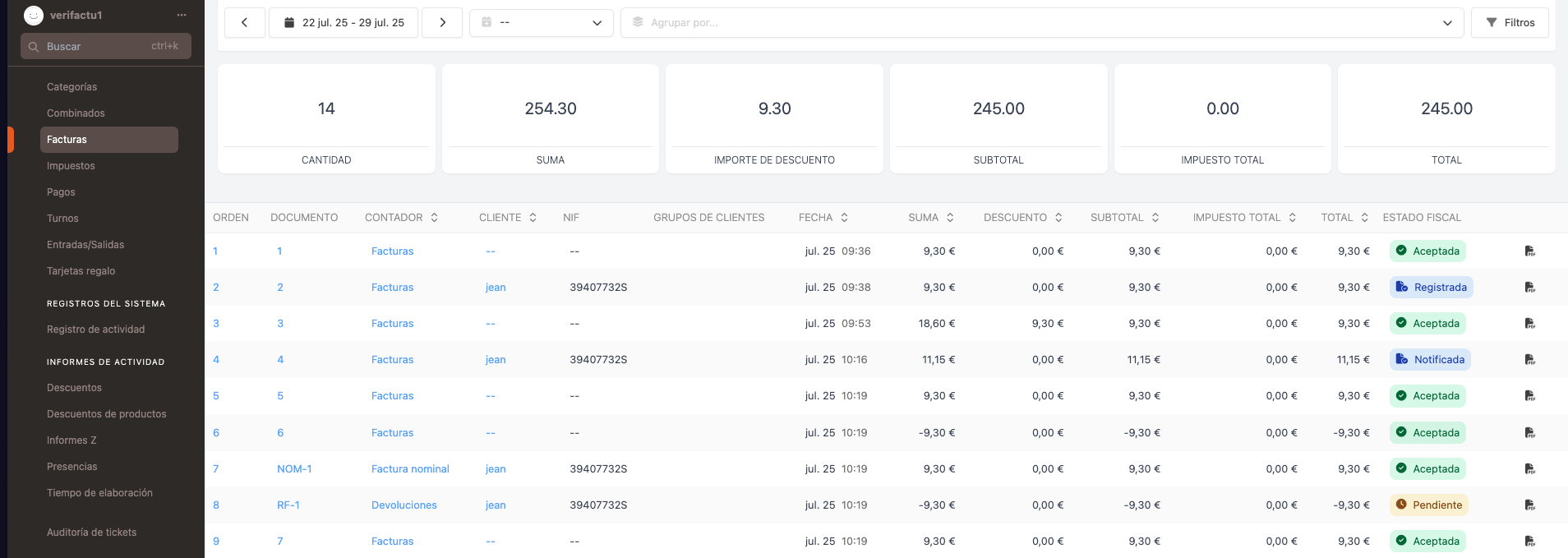

If you access Listings / INVOICES, you can see the Tax Status column.

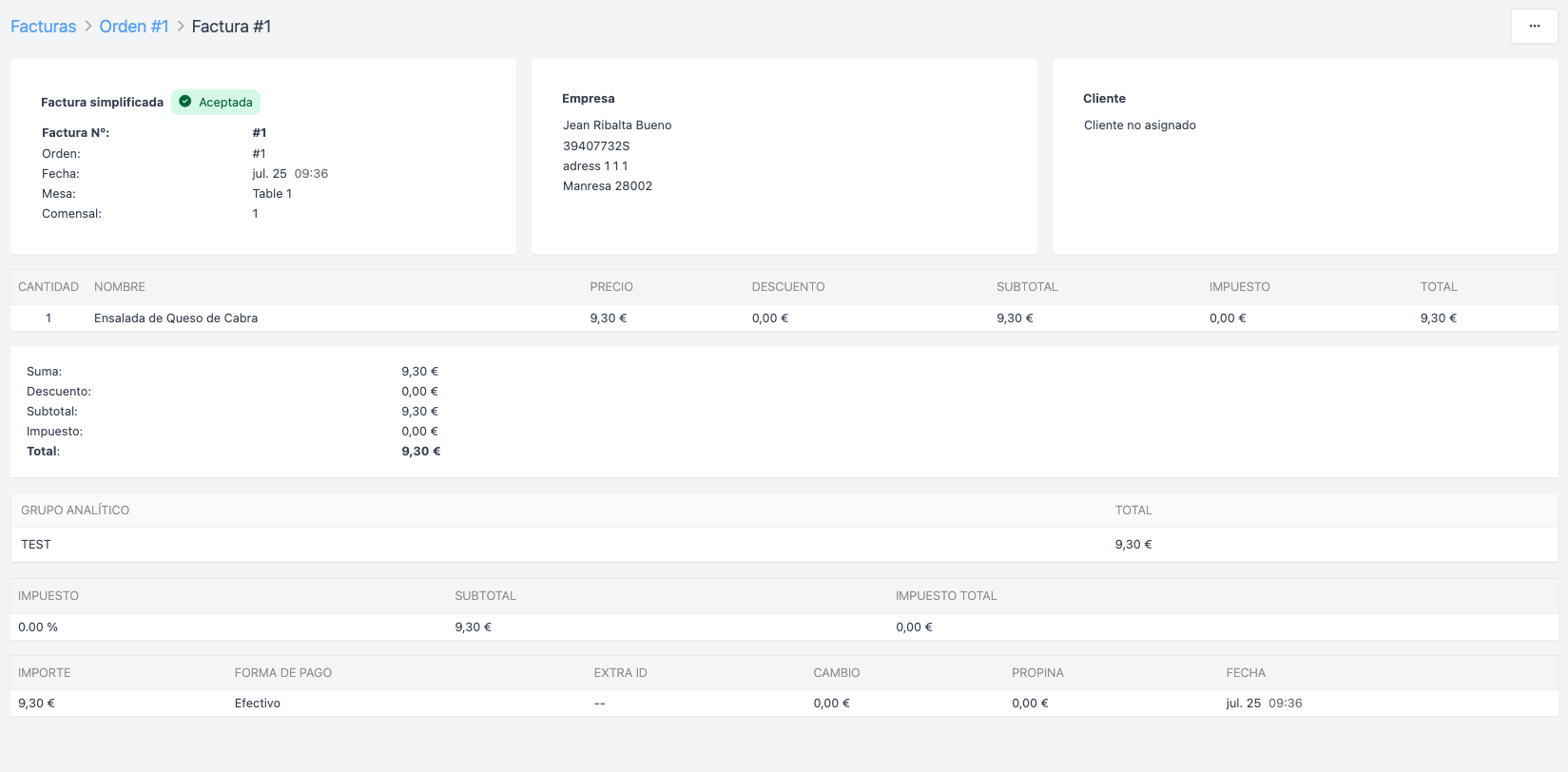

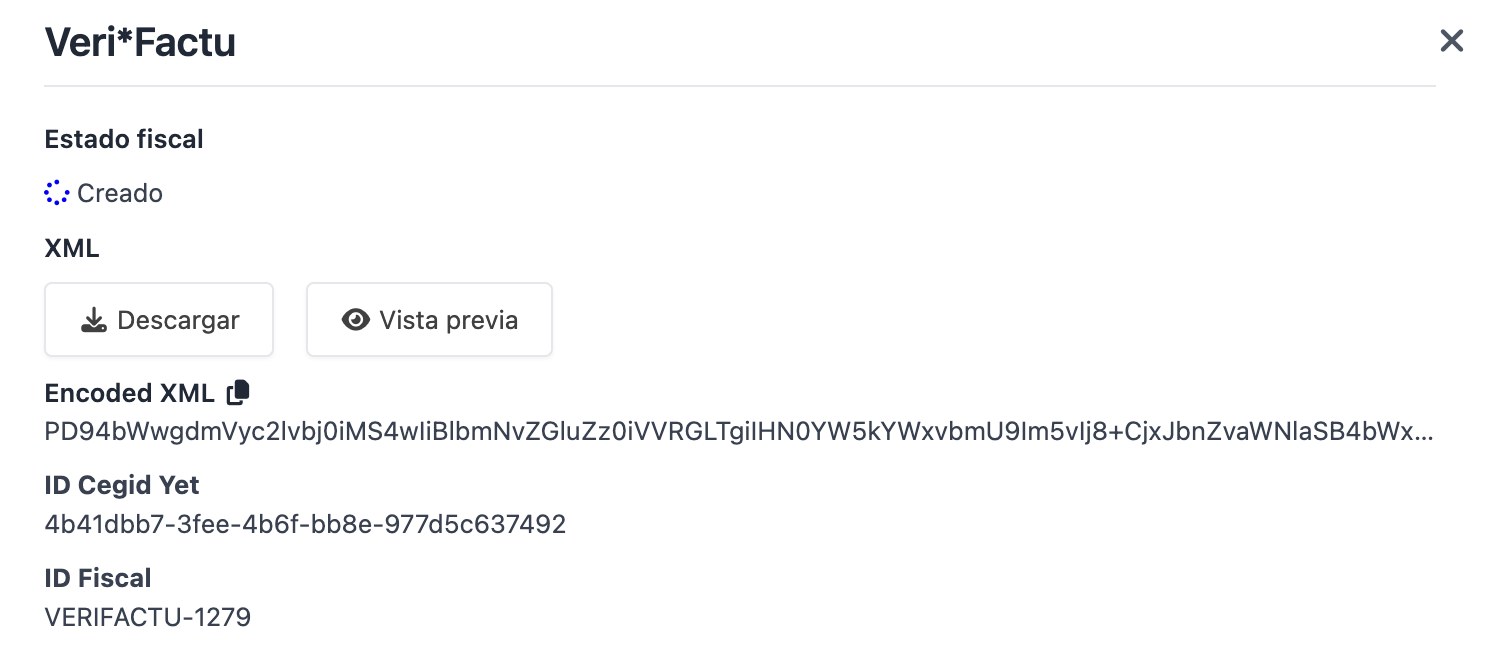

If you access the invoice and click on Tax Status, you can see more information about the invoice.

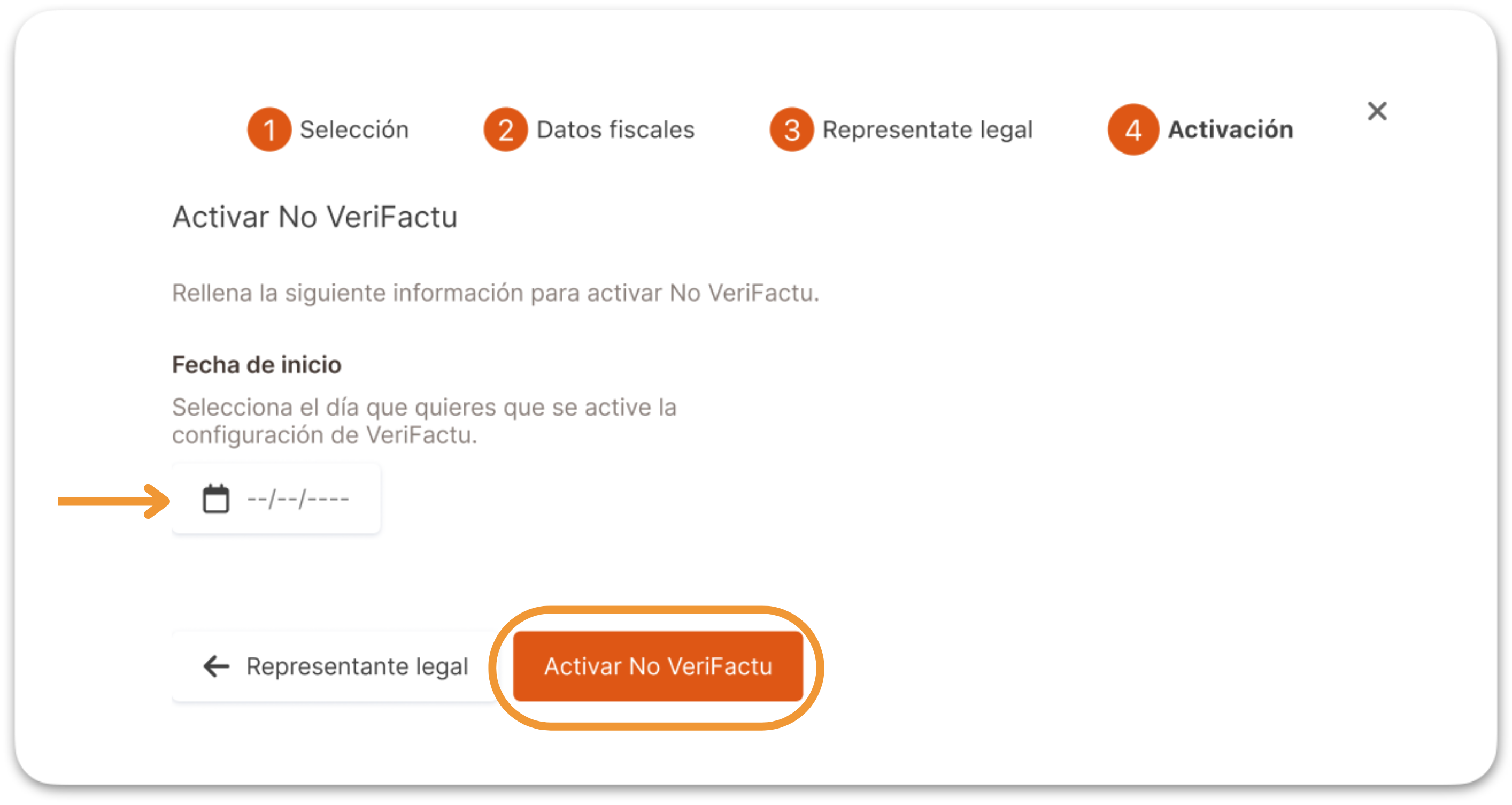

4. CONFIGURING NO VERIFACTU IN REVO

To use the "No VERIFACTU" mode, follow these steps:

-

Access the back-office of Revo Xef.

-

Click on "Configure Tax Settings" in the message that appears at the top of the screen.

- Select "Work with No VERIFACTU" as the tax settings and click "Continue".

- Review and fill in your company's tax data in the form. Then, click "Continue".

- Now fill in the legal representative's email.

-

Remember to check ✓ “I have reviewed and confirm my tax data.

-

Click "Continue".

- Click "Activate No VERIFACTU".

9. You can review your tax settings at any time in the back-office of Revo XEF, in the Settings / Company / TAX SETTINGS section.

Done! Your tax settings are activated!

Once activated, you will no longer be able to modify the tax country, and the message indicating activation will disappear.